nh tax return calculator

New Hampshire Tax Calculator. Approval and loan amount based on expected refund amount eligibility criteria and underwriting.

Income Tax Preparation Chicago Firms And Their Lawyers Now How Exactly The Filing Of Return Can Help Their Clients Hit The Tax Deductions Tax Debt Tax Time

The Current Use Board is proposing to readopt with Amendment Cub 30503 Cub 30504 -Assessment Ranges for Forest Land Categories With and Without.

. The new hampshire tax calculator is updated for the 202122 tax year. The New Hampshire income tax calculator is designed to provide a salary example with salary deductions made in. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

If you make 199000 in New. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. 300000 x 015 4500 transfer tax total.

New Hampshire Only Taxes Certain Income New Hampshire is one of two states that only taxes certain investment income. File Your Federal And State Tax Forms With TurboTax Get Every Dollar That You Deserve. Census Bureau Number of cities that have local income taxes.

Ad Free For Simple Tax Returns Only. The New Hampshire tax calculator is updated for the 202223 tax year. Our free online New Hampshire sales tax calculator calculates exact sales tax by state county city or ZIP code.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. New Hampshire NH State Income Taxes.

Switch to New Hampshire salary calculator. Please consider there is no state income tax in New Hampshire. New Hampshire income tax rate.

If an amended return enter amount paid with original return on line d. It is not your tax refund. While its not a fun number to calculate your portion of the transfer tax will be.

It is one of 9 states which do not have state income tax. Before the official 2022 New Hampshire income tax rates are released provisional 2022 tax rates are based on New Hampshires 2021 income tax brackets. The NH Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NHS.

ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. Line 10 The application will calculate the New Hampshire Interest and Dividends Tax and display the result. The gas tax in new hampshire is equal to 2220 cents per gallon.

Nh Tax Return Calculator. 4500 2 2250. The state only taxes interest and dividends at 5 on residents and fiduciaries whose gross interest and dividends income from all sources exceeds 2400 annually 4800 for joint.

In NH transfer tax is split in half by buyer and seller. A checklist on the New Hampshire Department of Revenue. We never collect sales tax on any of our items.

0 5 tax on interest and dividends Median household income. This is an optional tax refund-related loan from MetaBank NA. New Hampshire Salary Tax Calculator for the Tax Year 202122 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202122.

New Hampshire does not tax individuals earned income so you are not required to file an individual New Hampshire tax return. This New Hampshire hourly paycheck calculator is perfect for those who are paid on an hourly basis. To use our New Hampshire Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Take the purchase price of the property and multiply by 15. Take the purchase price of the property and multiply by 15. You can use our New Hampshire Sales Tax Calculator to look up sales tax rates in New Hampshire by address zip code.

The gas tax in new hampshire is equal to 2220 cents per gallon. Our online Annual tax calculator will automatically. Nh employment security nhes offers programs and services that will help your business.

If you make 199000 in New Hampshire what will your salary after tax be. If youre not satisfied come back it within over 8 weeks of shipment together with your dated receipt for a full refund excluding shipping handling. Switch to New Hampshire hourly calculator.

Get Your Max Refund Guaranteed With TurboTax. New Hampshire Hourly Paycheck Calculator. Deductions and personal exemptions are taken into account but some state-specific deductions and tax credit programs may not be accounted for.

New Hampshire has a 0 statewide sales tax rate and does not allow local. As such new hampshire interest dividends and business tax business profits tax and business enterprise tax returns that are due on friday april 15 2022 will be due on monday april 18 2022. Divide the total transfer tax by two.

Heres how to find that number. Start filing your tax return now. Being taxed for FICA purposes.

New Hampshire does not tax an individuals earned income W-2 wages. The state does tax at a 5 rate income from dividends and interest. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

We feel any extension to the april 15 2021 due date even by one month risks causing confusion and does not offer meaningful relief to taxpayers who will still need to complete their 2020 tax return in order to calculate the estimated tax payment that continues to be due on april. Line 11 Enter payments previously made from an a application for extension b estimated tax andor c credit carryover from prior year. Use our 2021 tax refund calculator to get your estimated tax refund or an idea of what youll owe.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Calculate your New Hampshire net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Hampshire paycheck calculator.

- New Hampshire State Tax. Income tax is not levied on wages. New Hampshire - Married Filing Jointly Tax Brackets.

Of that amount being taxed as federal tax. Loans are offered in amounts of 250 500 750 1250 or 3500. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

New Hampshire Paycheck Quick Facts. The 2022 state personal income tax brackets are. - FICA Social Security and Medicare.

Our income tax and paycheck calculator can help you understand your take home pay. 2020 New Hampshire Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. As such New Hampshire Interest Dividends and Business Tax Business Profits Tax and Business Enterprise Tax returns that are due on Friday April 15 2022 will be due on Monday April 18 2022.

TAX DAY NOW MAY 17th - There are -372 days left until taxes are due.

Taxes 2022 Important Changes To Know For This Year S Tax Season

Where S My Refund How To Track Your Tax Refund 2022 Money

Taxes Due Today Last Chance To File Your Tax Return Or Tax Extension On Time Cnet

The Irs Has Released Some Important Updates That All Mandated Aca Reporters Should Know About Health Insurance Plans Business Rules Health Insurance Coverage

Tax Return Form Hmrc High Resolution Stock Photography And Images Alamy

Changes In 2021 Aca Reporting Health Insurance Coverage How To Plan Irs Forms

New Hampshire Income Tax Nh State Tax Calculator Community Tax

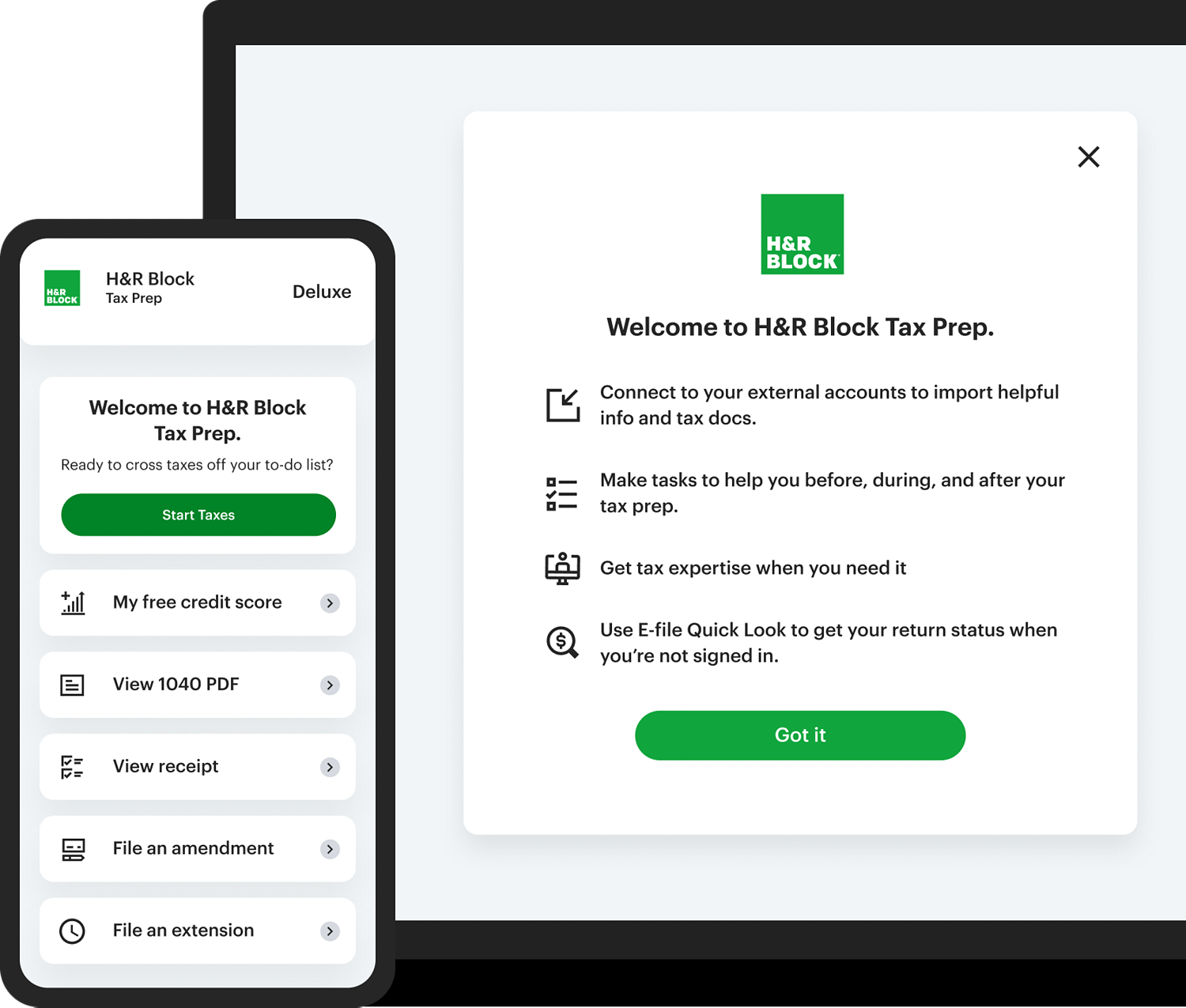

How To Fill Out A Fafsa Without A Tax Return H R Block

Tax Season 2022 When Can You File Taxes With Irs In 2022 Money

Here S The Average Irs Tax Refund Amount By State

Deluxe Online Tax Filing E File Tax Prep H R Block

Tax Return Form Hmrc High Resolution Stock Photography And Images Alamy

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance

Tax Return Form Hmrc High Resolution Stock Photography And Images Alamy

2021 Taxes A Comprehensive Guide To Filing Money

Dysfunctional Irs Can T Be Trusted To Pre Fill Tax Forms Insidesources